Article

Feb 10, 2026

The Missing Middle in DeFi Lending

Today’s market structure forces lenders into a false choice: accept money-market-like yields on blue-chips, or chase returns on sketchy, correlated collateral. Here’s how tranched markets break this trade-off.

This is the second in a series on how Lotus rethinks DeFi lending. If you haven’t read the introduction, start here.

If you've spent any time in DeFi lending, you've noticed the pattern. On one hand, conservative vaults lending against blue-chips pay barely above what you’d get in a money-market fund. The “high-yield” vaults offer tempting APYs, but when you look inside, you find lending against stablecoin funds, yield-bearing wrappers, and basis-trade derivatives. Assets that look stable until they aren't.

Why can't you earn high yields lending against blue-chip collateral?

It's a market structure problem. And market structure problems have market structure solutions.

Risk Segmentation & Liquidity Fragmentation

The core issue is the design of lending protocols and the resulting economic equilibria. Isolated lending markets cannot support risk segmentation without fragmenting liquidity. And fragmented liquidity doesn't just reduce efficiency; it collapses the risk spectrum back to one or two options. Here’s how that plays out:

One Set of Risk Parameters

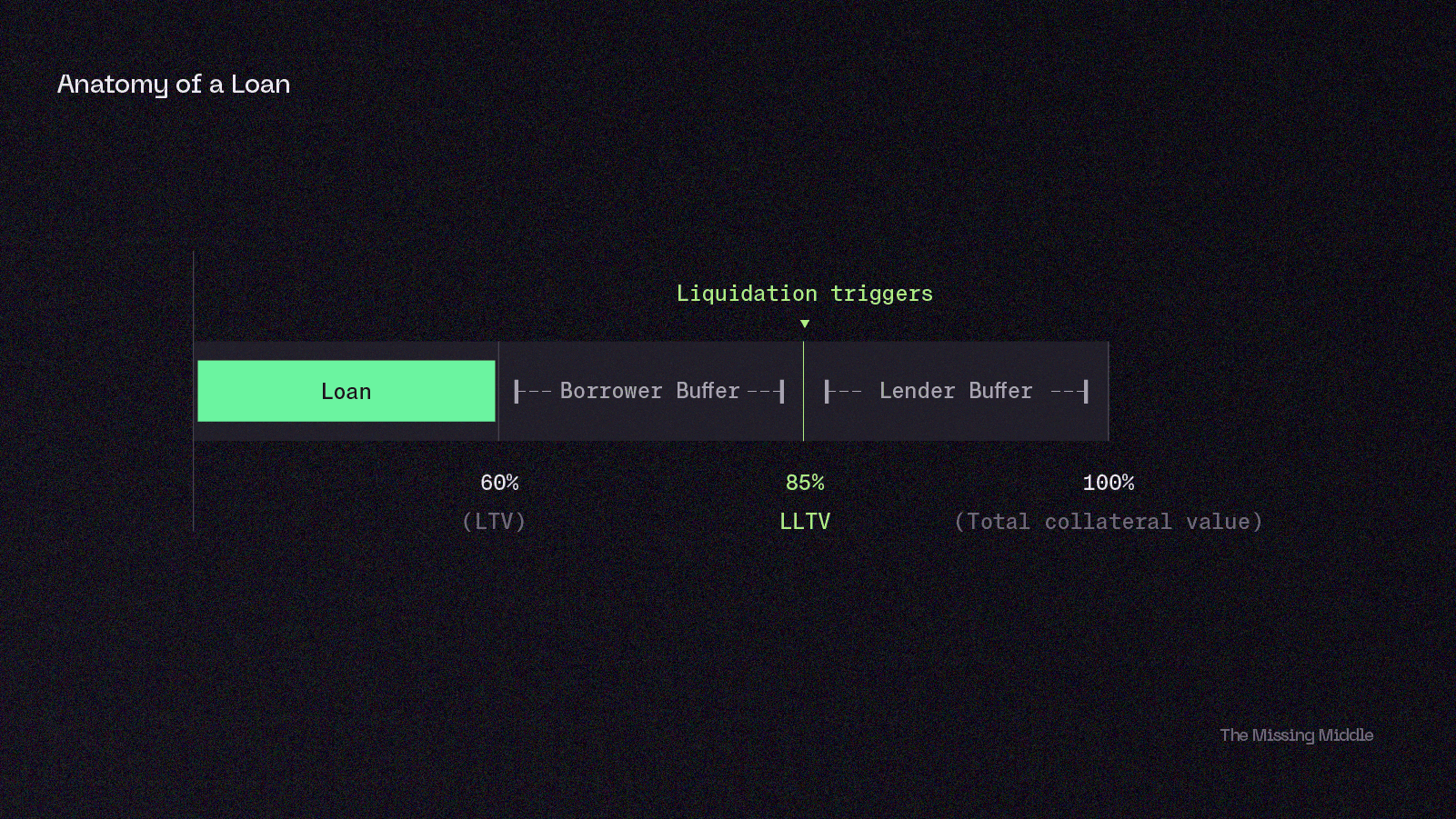

A critical risk parameter in lending markets is the liquidation loan-to-value ratio (LLTV). That is the threshold at which a position can be liquidated. Borrowers prefer a higher LLTV because, all else equal, they have more borrowing power, access to more leverage, and a lower liquidation price. Lenders prefer a lower LLTV because, in the event of a liquidation, there is a greater buffer to protect against bad debt.

To resolve this tension, protocols aim to set the LLTV as high as possible while keeping the probability of bad debt near zero. This is the only fair equilibrium. If you raise it any higher, you introduce the risk of loss for lenders who will demand a higher interest rate. Because all borrowers in the pool share the same risk parameters, the higher interest rate gets socialized across all borrowers. Even conservative borrowers at 20% loan-to-value (LTV) would pay the same as aggressive borrowers at 85% LTV.

Because the market is constrained to a single set of risk parameters, the LLTV is selected based on the borrower composition. Markets with blue-chip collateral tend to have conservative borrowers and, therefore, conservative LLTVs. Correlated markets cater strictly to highly leveraged loopers and have aggressive risk parameters. This is what ultimately creates the bifurcation in vault risk profiles and why you can’t currently lend at aggressive parameters (earn high supply rates) against blue-chip collateral.

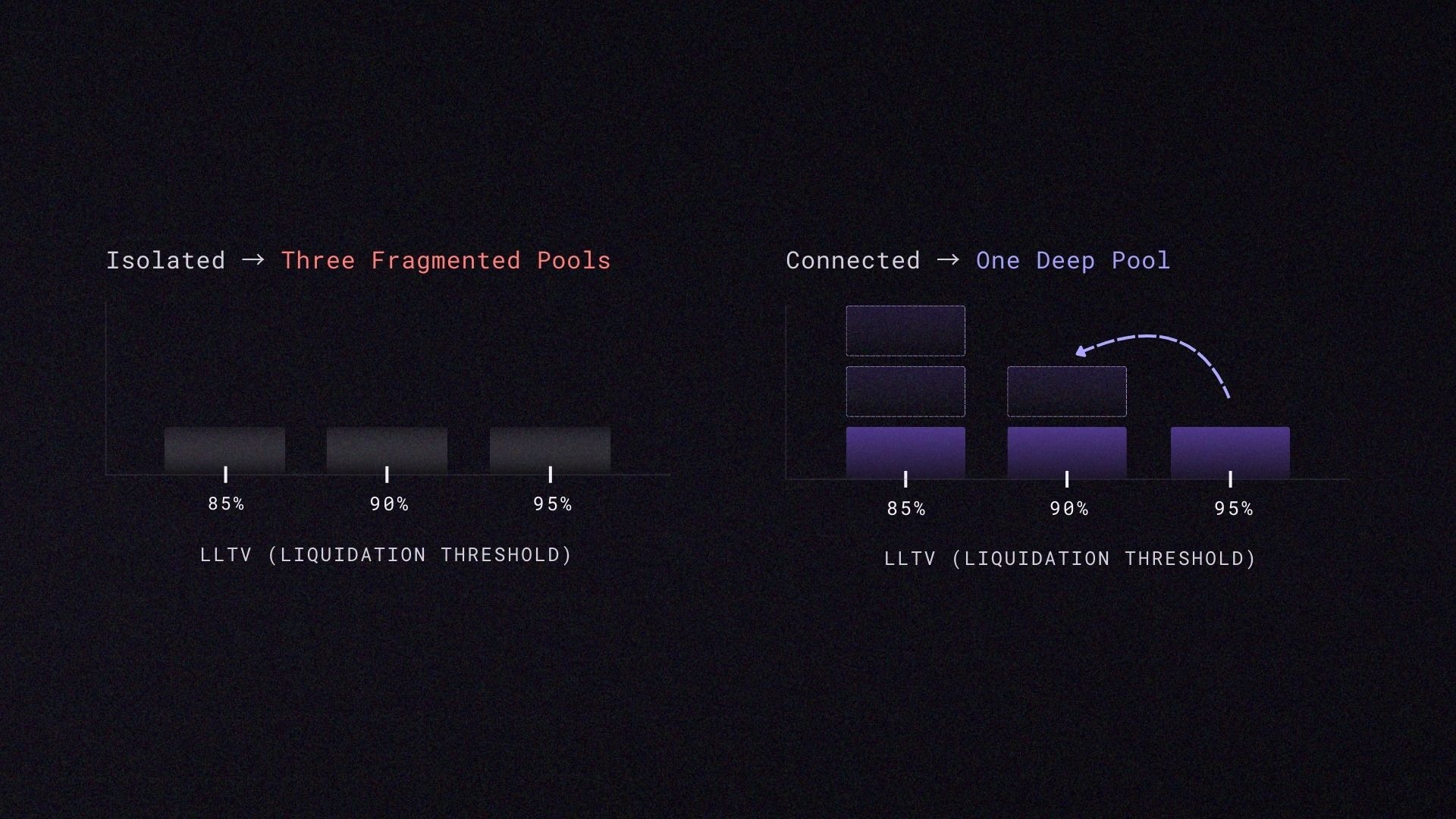

*The obvious fix is to create multiple markets with different LLTVs. Let borrowers and lenders sort themselves. But this breaks liquidity.

Why Isolated Markets Fail

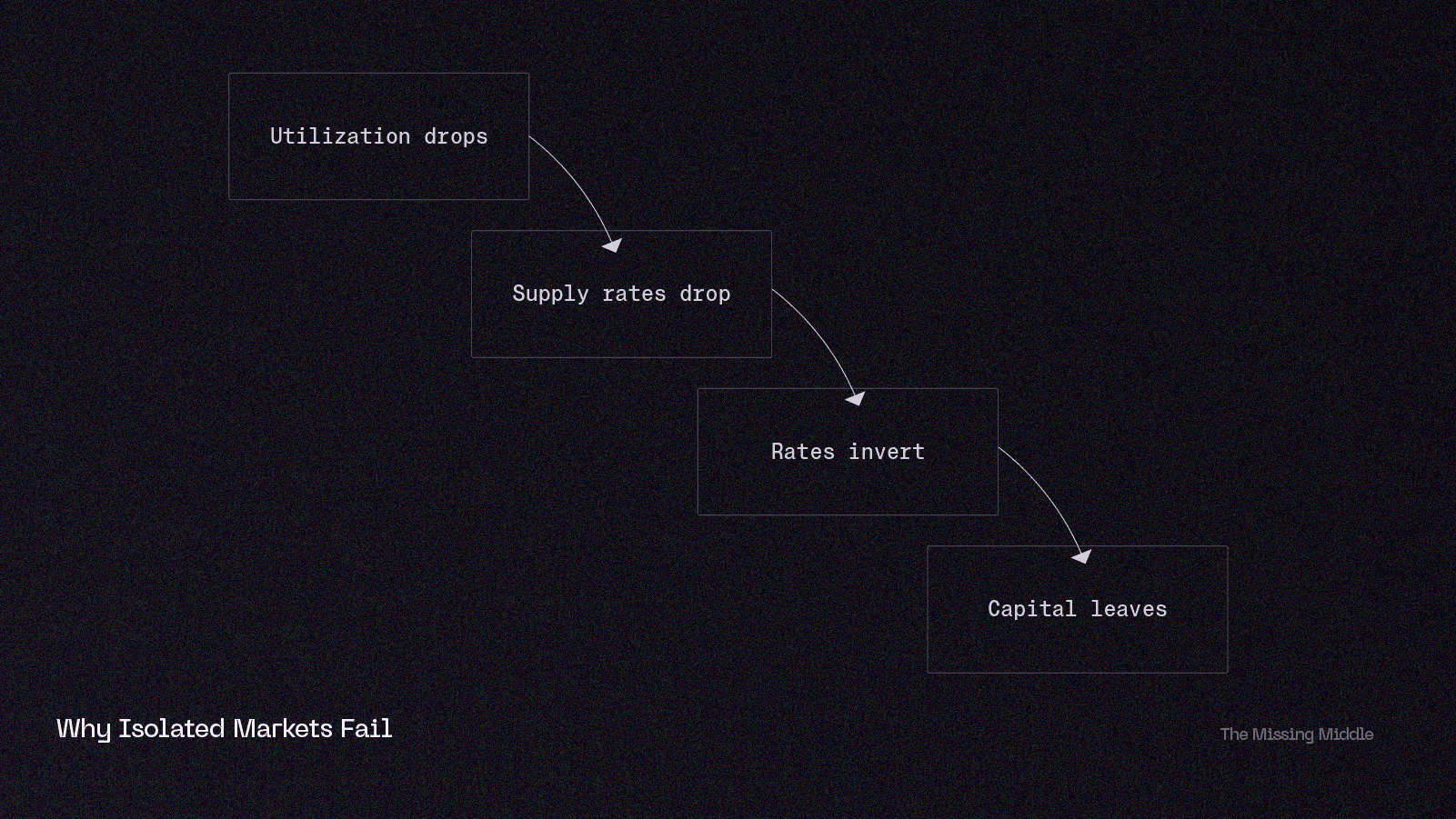

When you fragment liquidity across isolated risk tiers, the high-risk market collapses as soon as there is a drop in utilization:

Utilization becomes volatile. High-LLTV markets see demand spike during leverage cycles and crater during quiet periods. When utilization drops, supply rates drop with it.

Capital leaves. Lenders won't sit in a market earning nothing while waiting for borrowers. They migrate to the more stable, conservative market.

Rates invert. With less liquidity in the high-risk market, adaptive rate mechanisms push borrow rates down (to attract utilization). The "risky" market ends up with lower rates than the "safe" market, the opposite of what should happen.

The market dies. Without liquidity, the high-LLTV market can't serve borrowers even when demand exists. Everyone consolidates into the single conservative market.

This is why major lending protocols tend to converge on a single dominant market for each asset pair, with a conservative LLTV. The market structure makes risk segmentation impossible without destroying the market itself.

The Correlated Market Escape Hatch

So where do yield-seekers go? Correlated markets.

Lending against stablecoin funds and delta-neutral wrappers allows for aggressive parameters (LLTV of 94-96%, hard-coded oracles) because these assets don't exhibit daily volatility. However, when correlated collateral fails, it fails catastrophically. If you're lending at 94% LLTV against an asset that depegs by 50%, you lose roughly half your position. The difference between 90% LLTV and 94% LLTV barely matters when the collateral collapses.

This is the trade-off the market has settled on:

Collateral | Risk Profile | Yield |

BTC, ETH | Low day-to-day, low tail risk | Low |

Stablecoin funds, wrappers | Low day-to-day, high tail risk | High |

What's missing is the third option: earning high yields by lending against blue-chip assets. Unlike the catastrophic losses that result from lending against low-quality, correlated collateral, this absent strategy incurs smaller probabilistic losses during flash crashes. You can earn high yields by accepting small drawdowns and volatility without the risk that your portfolio teleports to zero.

The current market structure can't support it. Lotus can.

How Tranched Markets Work

Instead of isolated pools with different risk parameters, Lotus creates a single market where tranches share liquidity and rate information while keeping risk segmented.

Here's the architecture:

Shared Liquidity, Segmented Risk

A BTC-USDC market on Lotus has multiple tranches with LLTVs ranging from 80% to 95%. When you supply to the 90% tranche:

Your liquidity can be borrowed by anyone at 90% LLTV or below

If demand at 90% is low, your capital flows down to serve 85% or 80% borrowers

You are never exposed to borrowers at 91%+ LLTV

Liquidity flows in one direction: from riskier tranches to safer tranches. This solves the fragmentation problem. Capital in the 95% tranche isn't sitting idle when 95% demand is low; it's earning yield serving conservative borrowers. But it's still available when aggressive borrowers need it.

Connected Rate Information

Tranches share pricing signals. The market’s interest rate model enforces that borrowing rates at riskier tranches are never lower than rates at safer tranches. Combined with shared liquidity, this means:

Supply rates actually increase with LLTV (as they should)

No rate inversion from fragmented utilization

Market forces can properly price risk across the spectrum

The Result: A New Risk Profile

By enabling risk segmentation without liquidity fragmentation, Lotus unlocks lending positions that didn't exist before:

Tranche | LLTV | Risk Profile | Expected Yield |

Conservative | 80% | Near-zero bad debt | Base rate |

Moderate | 86% | Rare small losses | Base + premium |

Aggressive | 92% | Occasional small losses | Base + larger premium |

Maximum | 95% | More frequent small losses | Highest yield |

The 92% tranche on a BTC market might experience a small loss during a flash crash—say, 0.5% of supplied capital when BTC drops 15% in an hour and liquidations can't fully clear. But you're not exposed to the 50%+ wipeout risk of lending against a leveraged stablecoin wrapper.

This is a probabilistic, predictable risk. You can model it, price it, and decide if the yield compensates for it. That's fundamentally different from the binary tail risk in correlated markets.

Why This Matters

The current lending landscape forces a false choice. You either:

Accept returns that barely beat money-market funds

Take on opaque tail risk that's difficult to price and impossible to hedge

Lotus introduces a third path: earning premium yields on blue-chip collateral by accepting transparent, quantifiable risk.

For lenders who want yield without existential exposure, tranched markets change the game. You can finally get paid for taking more risk, not just different risk.

Stay in the loop: Follow on X | Join Telegram

Dive deeper: Explore our interactive docs

New to Lotus? Read the introduction